Menu

| Supervisor | > | Depreciation |

Mandatory Prerequisites

Prior to running the Depreciation Process, refer to the following Topics

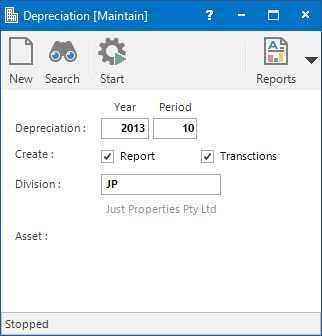

Screenshot and Field Descriptions: Depreciation

Depreciation Year, Period: this is the Accounting Period for which Depreciation, Revaluation and Disposal Journals will be created.

Report: tick this to generate a Report of Journals.

If this is ticked without Transactions being ticked, the Report will show a trial version of un-numbered Journals.

Transactions: tick this to generate Journal Transactions.

Division: this is the Division ID.

If left blank, all Divisions will be parsed for Asset Components flagged for Journal Transaction creation.

Asset: this is the run supplied ID of the Asset currently being parsed for selected Journal creation.

Component: this is the run supplied ID of the Asset Component currently being parsed for selected Journal creation.

How Do I : Search For and Maintain Entities

These General Rules are described in the Fundamentals Manual: How Do I : Search For and Maintain Entities

How Do I : Run the Depreciation Process

The Depreciation Process is associated with the following Topics: