Open topic with navigation

Maintaining Administration Fees

- The Administration Fees function allows you to nominate a fee structure to handle the cost of Administration and additional fees.

- Its primary function is to work with the raising of Lease a/c Charges, but it can also be applied to transactions raised through modules such as Outgoings, Utility Billing, etc.

- Administration fees can be for a fixed amount and / or a percentage, with different combinations being applied at different amount ranges.

- As an example, the Administration Fee will be applied to Lease Charges through the following steps:

- Create the Administration Fee profile.

- Attach the Administration Fee profile to selected Lease Charge lines in the Charges Tab of the Lease screen. Refer to Maintaining Leases: Charge Tab

- Running the Lease a/c Charges process will calculate the Administration Fee based on the Charge / Transaction amount.

- Both the Charge amount and Administration Fee are included as lines in the resulting Transaction.

Menu

| File |

> |

Financial Setup |

> |

Fees and Tariffs |

> |

Administration Fees |

Mandatory Prerequisites

Prior to creating an Administration Fee, refer to the following Topics:

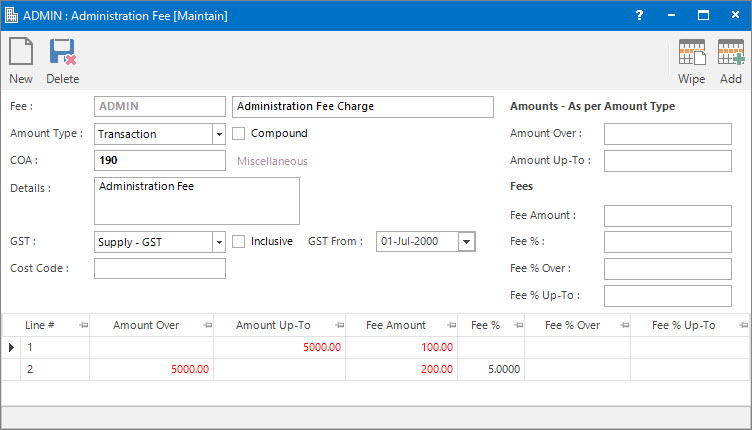

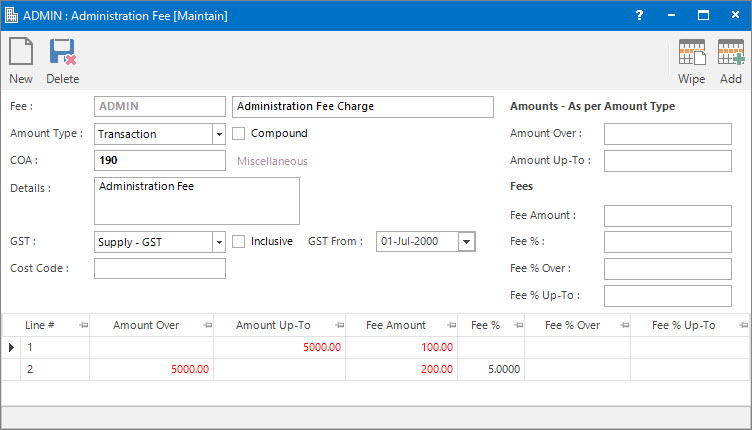

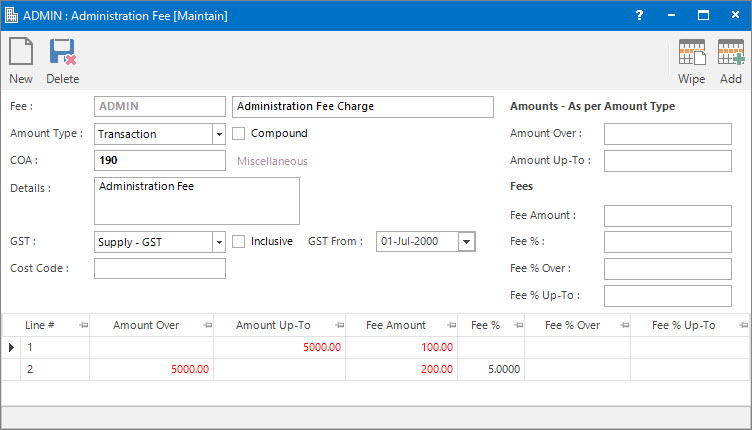

Screenshot and Field Descriptions

Header Fields:

These fields apply to the whole of the Administration Fee:

Fee: this is the primary identifier for the Administration Fee.

Fee: this is the primary identifier for the Administration Fee.

Name: this is the friendly name of the Administration Fee.

Name: this is the friendly name of the Administration Fee.

Amount Type: this is the drop down list of amount types that the Administration Fee can be calculated from:

Amount Type: this is the drop down list of amount types that the Administration Fee can be calculated from:

- Charge - the calculation will be based on the Charge Amount entered on the Lease Charge line. This is only applicable for the Lease a/c Charges processing.

- Transaction - the calculation will be based on the amount of the Transaction to be raised.

Compound: tick this check box if in the case of multiple Administration Fee lines being created within a Transaction, they should be consolidated into a single fee transaction line.

COA: this is the Chart of Account for the calculated Administration Fee transaction line.

COA: this is the Chart of Account for the calculated Administration Fee transaction line.

Details: this is the description for the Administration Fee transaction line. It will default to the value set up for the COA.

GST: this is the GST Type for the Administration Fee transaction line. It will default to the type set up for the COA.

Inclusive: this check box determines if the Administration Fee Amount includes GST. If this field is ticked, when the GST is calculated, the Amount will be reduced by the GST and the tick will disappear to reflect that the line no longer includes GST. If this check box is not ticked, the Administration Fee Amount will not be reduced and the GST will be calculated normally.

GST From: this is a historical field and current use is now irrelevant. It was used during the implementation of GST to allow contractual date based transactions to escape full GST. There may be old transactions on the system to which the rule applied.

Cost Code: this is the cost centre that the Administration Fee amounts relate to. This field can be set as optional, mandatory or not required on the COA set up screen.

Cost Code: this is the cost centre that the Administration Fee amounts relate to. This field can be set as optional, mandatory or not required on the COA set up screen.

Range Line Items:

These fields apply to multiple value based ranges in the Fee Range table.

Amounts - As per Amount Type

This is the where the Ranges to apply the Fee are specified.

Amount Over: this is the lower range of the Fee line. It can be left blank.

Amount Up-To: this is the upper range of the Fee line. It can be left blank.

Fees

Fee Amount: this is the fixed amount to be raised for the Range.

Fee %: this is the percentage of the amount to be raised for the Range.

A fixed amount plus a percentage can be raised.

Fee % Over: if a Fee % is entered, this is an optional lower amount within the range specified in the Amount Over and Amount Up-To fields, to apply the Fee %.

Fee % Up-To: if a Fee % is entered, this is an optional upper amount within the range specified in the Amount Over and Amount Up-To fields, to apply the Fee %.

Range Lines table: this contains rows of non overlapping amount ranges and their parameters. Existing rows can be deleted or changed by selecting and double clicking. Their content can be maintained in the Range Line Items fields.

How Do I : Add a new Administration Fee

Header Fields:

These apply to the whole Administration Fee:

- At the Fee field, enter a new Administration Fee ID.

- At the Name field, enter the name of the Administration Fee.

- At the Amount Type drop down list select the amount type that the Administration Fee will be calculated from.

- Tick the Compound check box if multiple Administration Fee lines need to be consolidated into a single fee transaction line.

- At the COA field, locate the Chart of Account to raise the Administration Fee transaction lines to.

- The Details field will automatically populate from the COA selected. Change the value if required.

- The GST field will automatically populate from the COA selected. Change the value if required.

- Tick the Inclusive check box if the Administration Fee amounts will include GST. Otherwise the GST component will be calculated and added separately.

- The GST From date will default to the value set up for GST.

- At the Cost Code field, enter the Cost Code for the Administration Fee transactions if required.

Range Line Items:

Repeat for each Range Line:

- At the Amount Over field, if required, enter the lower range of the Fee line.

- At the Amount Up-To field, if required, enter the upper range of the Fee line.

- At the Fee Amount field, enter an amount if a component of the Fee is based on a fixed amount.

- At the Fee % field, enter a percentage if a component of the Fee is based on a percentage of the amount to be raised.

- If the Fee % is entered, optionally, enter the lower amount within the Range specified above to apply the percentage in the Fee % Over field.

- If the Fee % is entered, optionally, enter the upper amount within the Range specified above to apply the percentage in the Fee % Up-To field.

- Click the Right Hand Side Application tool-bar push button: Add to add the Range Line to the Range Lines table.

Final:

- Click the Left Hand Side Application tool-bar push button: Add, and

confirm that you wish to save the whole Administration Fee.

How Do I : Modify an existing Administration Fee

- At the Fee field, locate an Administration Fee.

- Make changes to the Header Fields as required.

- For the Range Line Items the user has the following options:

- Add a new line by entering in the Range Line Item fields and clicking the Right Hand Side Application tool-bar push button: Add to add the Range Line to the Range Lines table.

- Change an existing line by double clicking a line in the Range Lines table, modifying any of the Range Line Item fields and clicking the Right Hand Side Application tool-bar push button: Change.

- Delete an existing line by double clicking a line in the Range Lines table and clicking the Right Hand Side Application tool-bar push button: Delete.

- If the Range Line Item fields need to be cleared, click the Right Hand Side Application tool-bar push button: Wipe.

- Click the Left Hand Side Application tool-bar push button: Change, and

confirm that you wish to save the whole Administration Fee.

How Do I : Delete an Administration Fee

- At the Fee field, locate an Administration Fee.

- Click the Application tool-bar push button: Delete.

- Confirm that you wish to delete the record.

How Do I : Set up a Fixed Amount Administration Fee

- This is where you want to add a fixed Administration fee regardless of the amount being raised.

Refer to How Do I : Add a new Administration Fee noting the following fields:

- It doesn't matter what value is selected in the Amount Type drop down list.

- Leave the Amount Over and Amount Up-To range fields blank, ie. no restriction on range.

- At the Fee Amount field, enter the fixed amount.

How Do I : Set up a Percentage Administration Fee

- This is where you want to add a percentage Administration fee based on the amount being raised.

Refer to How Do I : Add a new Administration Fee noting the following fields:

- At the Amount Type drop down list, select if the percentage is going to be calculated from the Charge amount of the Lease Charge Line or the Transaction amount that is going to be raised.

- Leave the Amount Over and Amount Up-To range fields blank, ie. no restriction on range.

- At the Fee % field, enter the percentage.

How Do I : Set up a combined Fixed Amount and Percentage Administration Fee

- This is where you want to have a fixed fee component in addition to a percentage fee based on the amount being raised.

- For a fixed fee of $100 and a percentage fee of 10% the calculation would be:

Administration Fee on $12,000 = 100 + ($12,000 * 10%) = $1,300.

Refer to How Do I : Add a new Administration Fee noting the following fields:

- At the Amount Type drop down list, select if the percentage is going to be calculated from the Charge amount of the Lease Charge Line or the Transaction amount that is going to be raised.

- Leave the Amount Over and Amount Up-To range fields blank, ie. no restriction on range.

- At the Fee Amount field, enter 100.

- At the Fee % field, enter 10.

How Do I : Set up a Fixed Amount and / or Percentage Administration Fee based on the Amount falling within a Range

- This is where you want to only raise an Administration fee if the Amount falls within a range.

- For example a fixed fee of $100, where the Amount Over value is set to 5,000:

Administration Fee on $12,000 = $100 as it exceeds 5,000.

Refer to How Do I : Add a new Administration Fee noting the following fields:

- At the Amount Type drop down list, select if the fee is going to be calculated from the Charge amount of the Lease Charge Line or the Transaction amount that is going to be raised.

- At the Amount Over and Amount Up-To range fields, enter the range or leave either blank to keep the range open ended.

- At the Fee Amount field, if required, enter the fixed amount.

- At the Fee % field, if required, enter the percentage.

How Do I : Set up a Percentage Administration Fee on only a portion of the Amount

- This is where you want to add a percentage Administration fee on only a portion of the amount being raised.

- For example a percentage of 10% on the Amount over the value of 5,000:

Administration Fee on $12,000 = 12,000 - 5,000 = 7,000 * 10% = $700.

Refer to How Do I : Add a new Administration Fee noting the following fields:

- At the Amount Type drop down list, select if the percentage is going to be calculated from the Charge amount of the Lease Charge Line or the Transaction amount that is going to be raised.

- Leave the Amount Over and Amount Up-To range fields blank, ie. no restriction on range.

- At the Fee % field, enter the percentage.

- At the Fee % Over and Fee % Up-To range fields, enter the range or leave either blank to keep the range open ended.

Related Topics

Administration Fees are associated with the following Topics:

Fee: this is the primary identifier for the Administration Fee.

Name: this is the friendly name of the Administration Fee.

Amount Type: this is the drop down list of amount types that the Administration Fee can be calculated from:

COA: this is the Chart of Account for the calculated Administration Fee transaction line.

Cost Code: this is the cost centre that the Administration Fee amounts relate to. This field can be set as optional, mandatory or not required on the COA set up screen.